Compound 白皮书和核心代码,大佬已经写了很详细的文档,见

Compound白皮书简述

Compound合约部署

Compound合约升级模式

这里补充下周边: COMP 代币 和 价格预言

COMP

投放计划

为了激励用户,用户每次存款或者借款,Compound 都会奖励 COMP 代币,可以用于治理投票

COMP 每日总产出约为 2312 枚,各市场的分布见 文档,部分市场如下

| Market | Per Day |

|---|---|

| DAI | 880.38 |

| Ether | 141.25 |

| USDC | 880.38 |

| USDT | 126.80 |

每个市场,借款和存款产出的 COMP,分别占 50%

以 USDC 市场为例,每日共产出 880.38 枚 COMP,其中通过借款的方式投放 440.19 枚 COMP,借款用户按其借款额度占总借款额度的比例分配;存款同理

配置

如上所述,根据各市场每日产出的 COMP 数量,按每 15 秒一个区块的假设,可以得到每个区块产出的 COMP 数量,记录在 ComptrollerV6Storage 中

contract ComptrollerV6Storage is ComptrollerV5Storage {

// https://compound.finance/governance/comp

/// @notice The rate at which comp is distributed to the corresponding borrow market (per block)

mapping(address => uint) public compBorrowSpeeds;

/// @notice The rate at which comp is distributed to the corresponding supply market (per block)

mapping(address => uint) public compSupplySpeeds;

}compBorrowSpeeds 和 comSupplySpeeds 为 cToken 到每区块产出 COMP 数量的映射

比如对 cUSDC 来说,它在两个映射表中的值都为 67000000000000000 (COMP 的精度为 {10}^{18})

\frac{2 \times 67000000000000000 \times 86400}{15} \approx 880.38 \times {10}^{18}存款挖矿

用户每次操作,只要可能更新存款,如存款操作,会触发 mintAllowed(),它进一步

- 调用 updateCompSupplyIndex() 更新当前市场的 COMP 存款指数

- 调用 distributeSupplierComp() 分发当前用户此前未结算的存款产出的 COMP

function mintAllowed(address cToken, address minter, uint mintAmount) external returns (uint) {

// Keep the flywheel moving

updateCompSupplyIndex(cToken);

distributeSupplierComp(cToken, minter);

return uint(Error.NO_ERROR);

}--

当前市场的 COMP 存款指数更新逻辑如下

/**

* @notice Accrue COMP to the market by updating the supply index

* @param cToken The market whose supply index to update

* @dev Index is a cumulative sum of the COMP per cToken accrued.

*/

function updateCompSupplyIndex(address cToken) internal {

CompMarketState storage supplyState = compSupplyState[cToken];

uint supplySpeed = compSupplySpeeds[cToken];

uint32 blockNumber = safe32(getBlockNumber(), "block number exceeds 32 bits");

uint deltaBlocks = sub_(uint(blockNumber), uint(supplyState.block));

if (deltaBlocks > 0 && supplySpeed > 0) {

uint supplyTokens = CToken(cToken).totalSupply();

uint compAccrued = mul_(deltaBlocks, supplySpeed);

Double memory ratio = supplyTokens > 0 ? fraction(compAccrued, supplyTokens) : Double({mantissa: 0});

supplyState.index = safe224(add_(Double({mantissa: supplyState.index}), ratio).mantissa, "new index exceeds 224 bits");

supplyState.block = blockNumber;

} else if (deltaBlocks > 0) {

supplyState.block = blockNumber;

}

}首先判断距离上次更新指数,经过了几个区块 deltaBlocks,另外根据 supplySpeed 判断当前市场是否产出 COMP (0x, Aave 等配置为 0,表示不产出)

条件都满足后,计算 COMP 产出数量,除以 cToken 总供给,得到这几个区块间,平均每个 cToken 对应的 COMP 产出,即代码中的 ratio

也就是说,ratio 可以理解为每持有一个 cToken ,可以得到多少 COMP

最后将 ratio 累加进 COMP 存款指数

--

当前用户此前未结算的 COMP 分发逻辑如下

/**

* @notice Calculate COMP accrued by a supplier and possibly transfer it to them

* @param cToken The market in which the supplier is interacting

* @param supplier The address of the supplier to distribute COMP to

*/

function distributeSupplierComp(address cToken, address supplier) internal {

// TODO: Don't distribute supplier COMP if the user is not in the supplier market.

// This check should be as gas efficient as possible as distributeSupplierComp is called in many places.

// - We really don't want to call an external contract as that's quite expensive.

CompMarketState storage supplyState = compSupplyState[cToken];

uint supplyIndex = supplyState.index;

uint supplierIndex = compSupplierIndex[cToken][supplier];

// Update supplier's index to the current index since we are distributing accrued COMP

compSupplierIndex[cToken][supplier] = supplyIndex;

if (supplierIndex == 0 && supplyIndex >= compInitialIndex) {

// Covers the case where users supplied tokens before the market's supply state index was set.

// Rewards the user with COMP accrued from the start of when supplier rewards were first

// set for the market.

supplierIndex = compInitialIndex;

}

// Calculate change in the cumulative sum of the COMP per cToken accrued

Double memory deltaIndex = Double({mantissa: sub_(supplyIndex, supplierIndex)});

uint supplierTokens = CToken(cToken).balanceOf(supplier);

// Calculate COMP accrued: cTokenAmount * accruedPerCToken

uint supplierDelta = mul_(supplierTokens, deltaIndex);

uint supplierAccrued = add_(compAccrued[supplier], supplierDelta);

compAccrued[supplier] = supplierAccrued;

emit DistributedSupplierComp(CToken(cToken), supplier, supplierDelta, supplyIndex);

}首先获取市场最新的 COMP 存款指数,以及用户此前结算时的指数,相减得到 deltaIndex

然后乘以用户持有的 cToken 数量,得到用户这段时间应该获得的 COMP

--

需要说明的是,这里结算的是用户之前的存款,占当前总供给的百分比,不会算入用户接下来马上将改变的存款

换句话说,存款余额的修改,要在至少一个区块之后才会被用于结算 COMP,即用户操作与 COMP 结算是跨区块的

算是降低了被闪电贷攻击的风险

借款挖矿

与存款挖矿大同小异,稍微复杂一些,这里不再赘述

通胀

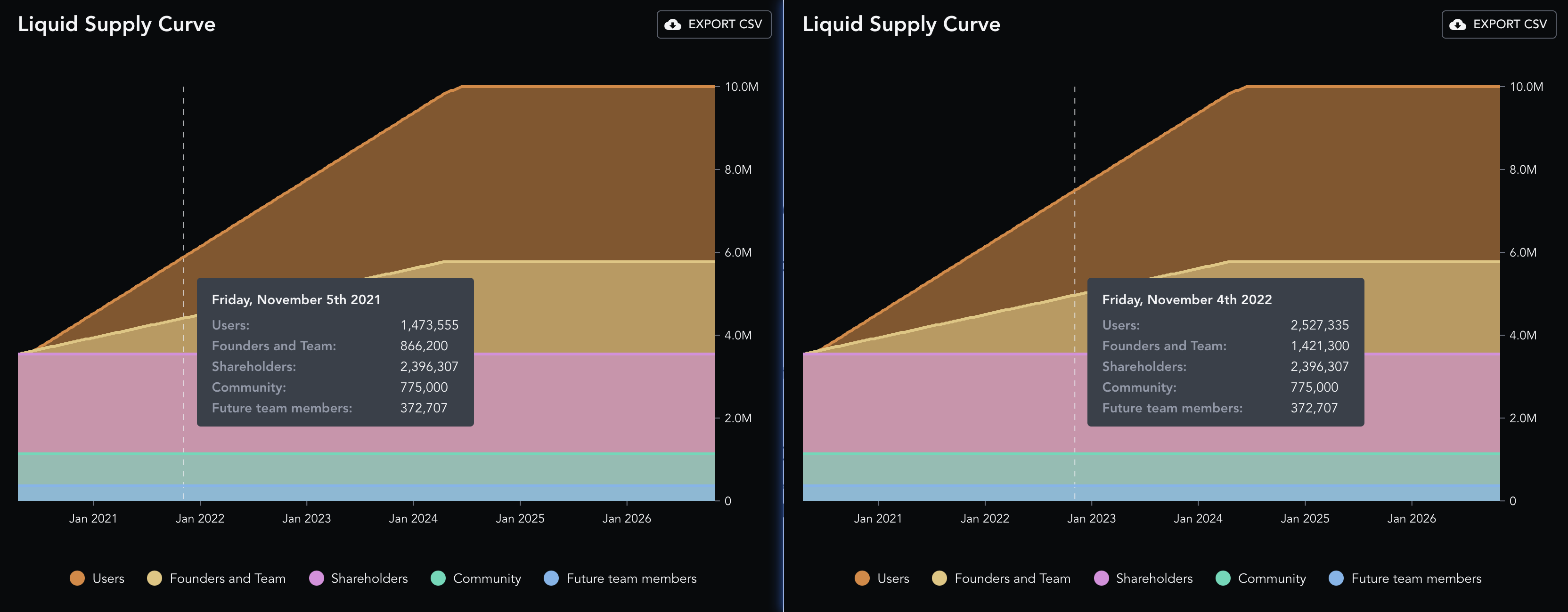

根据 messari,COMP 的 Inflation Rate 为 27.50%

我没找到其确切公式,不过我们可以自行计算,根据 2021-11-05 和 2022-11-04 的 流动性投放计划 ,简单相除得到通胀系数为 27.34%;和 messari 数据相比,算是大差不差了

| - | 2021-11-05 | 2022-11-04 | Inflation Rate |

|---|---|---|---|

| User | 1,473,555 | 2,527,335 | |

| Founder and Team | 866,200 | 1,421,300 | |

| Shareholders | 2,396,307 | 2,396,307 | |

| Community | 775,000 | 775,000 | |

| Future team members | 372,797 | 372,797 | |

\sum |

5,883,859 | 7,492,379 | +27.34% |

但是,这里有个统计陷阱:Founders & team 分批 vest 且 Future team members 也未兑现,部分流动性没有进入市场,因此分母偏大了

也就是说,实际通胀率还要高出不少

不管怎样,通胀率接近甚至超过 30% 的资产,价格稳定在 $100 ~ $300;我看不懂,但我大受震撼~

安全

9月29日 Compound 发生一起安全事件,详见 [事件分析] 9月29日 Compound 62号提案 所引发的可怕Bug

其中,Robert Leshner 提到的 Reservori 合约 (地址),就是上面投放计划中 User (借贷挖矿) 的 COMP 来源

价格预言机

Compound 同时使用 Uniswap v2 和 Chainlink v2 作为价格预言机

Chainlink 价格以 Uniswap 价格为锚,前者作为实际价格,后者作为基准价格

Chainlink 价格需要在 Uniswap 价格的某段浮动范围内,才能作为有效价格被更新到预言机

代码

compound-finance/open-oracle 中只有 Uniswap 相关代码,我找遍 branches 和 tags 都没找到 Chainlink 部分

最后在 Compound 社区找到这个关于添加 Chainlink 预言机提案的精彩讨论 Oracle Infrastructure: Chainlink Proposal

成果是 Chainlink 团队在 Compound 原有 Open Price Feed 的代码基础上,集成了 Chainlink 聚合器的报价,并进一步做了部署和测试;Compound 社区通过治理,应用了新的预言机

然而,Chainlink 提交的 PR:Oracle Improvement (Chainlink Price Feeds) #150,改动较多,还卡在审核阶段,未被合并..

因此,最新代码不在官方仓库中

审计报告见 Trail of Bits: Chainlink Open-Oracle Summary Report

以下分析基于 Chainklink fork 的仓库 smartcontractkit/open-source

实现

/**

* @notice This is called by the reporter whenever a new price is posted on-chain

* @dev called by AccessControlledOffchainAggregator

* @param currentAnswer the price

* @return valid bool

*/

function validate(uint256/* previousRoundId */,

int256 /* previousAnswer */,

uint256 /* currentRoundId */,

int256 currentAnswer) external override returns (bool valid) {

// NOTE: We don't do any access control on msg.sender here. The access control is done in getTokenConfigByReporter,

// which will REVERT if an unauthorized address is passed.

TokenConfig memory config = getTokenConfigByReporter(msg.sender);

uint256 reportedPrice = convertReportedPrice(config, currentAnswer);

uint256 anchorPrice = calculateAnchorPriceFromEthPrice(config);

PriceData memory priceData = prices[config.symbolHash];

if (priceData.failoverActive) {

require(anchorPrice < 2**248, "Anchor price too large");

prices[config.symbolHash].price = uint248(anchorPrice);

emit PriceUpdated(config.symbolHash, anchorPrice);

} else if (isWithinAnchor(reportedPrice, anchorPrice)) {

require(reportedPrice < 2**248, "Reported price too large");

prices[config.symbolHash].price = uint248(reportedPrice);

emit PriceUpdated(config.symbolHash, reportedPrice);

valid = true;

} else {

emit PriceGuarded(config.symbolHash, reportedPrice, anchorPrice);

}

}核心代码如上所示

validate() 由 Chainlink 调用,参数 currentAnswer 表示 Chainlink 链下统计的价格,单位由 Chainlink 控制

以 DAI 为例,假设 currentAnswer 为 100055330

为了方便处理,convertReportedPrice() 将其转为内部单位,得到 1000553

calculateAnchorPriceFromEthPrice() 通过向交易对询价得到链上 Uniswap 交易所的价格,比如为 1001190

接下来判断 failoverActive,这是由社区投票决定的一项配置,表示当前市场 (DAI) 是否忽略 Chainlink 价格,以 Uniswap 价格为准

否则,通过 isWithAnchor() 确认 Chainlink 价格在 Uniswap 价格浮动范围内 ([85%, 115%])

--

/**

* @notice Calculate the anchor price by fetching price data from the TWAP

* @param config TokenConfig

* @return anchorPrice uint

*/

function calculateAnchorPriceFromEthPrice(TokenConfig memory config) internal returns (uint anchorPrice) {

uint ethPrice = fetchEthAnchorPrice();

require(config.priceSource == PriceSource.REPORTER, "only reporter prices get posted");

if (config.symbolHash == ethHash) {

anchorPrice = ethPrice;

} else {

anchorPrice = fetchAnchorPrice(config.symbolHash, config, ethPrice);

}

}

/**

* @dev Fetches the current eth/usd price from uniswap, with 6 decimals of precision.

* Conversion factor is 1e18 for eth/usdc market, since we decode uniswap price statically with 18 decimals.

*/

function fetchEthAnchorPrice() internal returns (uint) {

return fetchAnchorPrice(ethHash, getTokenConfigBySymbolHash(ethHash), ethBaseUnit);

}

/**

* @dev Fetches the current token/usd price from uniswap, with 6 decimals of precision.

* @param conversionFactor 1e18 if seeking the ETH price, and a 6 decimal ETH-USDC price in the case of other assets

*/

function fetchAnchorPrice(bytes32 symbolHash, TokenConfig memory config, uint conversionFactor) internal virtual returns (uint) {

(uint nowCumulativePrice, uint oldCumulativePrice, uint oldTimestamp) = pokeWindowValues(config);

// This should be impossible, but better safe than sorry

require(block.timestamp > oldTimestamp, "now must come after before");

uint timeElapsed = block.timestamp - oldTimestamp;

// Calculate uniswap time-weighted average price

// Underflow is a property of the accumulators: https://uniswap.org/audit.html#orgc9b3190

FixedPoint.uq112x112 memory priceAverage = FixedPoint.uq112x112(uint224((nowCumulativePrice - oldCumulativePrice) / timeElapsed));

uint rawUniswapPriceMantissa = priceAverage.decode112with18();

uint unscaledPriceMantissa = mul(rawUniswapPriceMantissa, conversionFactor);

uint anchorPrice;

// Adjust rawUniswapPrice according to the units of the non-ETH asset

// In the case of ETH, we would have to scale by 1e6 / USDC_UNITS, but since baseUnit2 is 1e6 (USDC), it cancels

// In the case of non-ETH tokens

// a. pokeWindowValues already handled uniswap reversed cases, so priceAverage will always be Token/ETH TWAP price.

// b. conversionFactor = ETH price * 1e6

// unscaledPriceMantissa = priceAverage(token/ETH TWAP price) * expScale * conversionFactor

// so ->

// anchorPrice = priceAverage * tokenBaseUnit / ethBaseUnit * ETH_price * 1e6

// = priceAverage * conversionFactor * tokenBaseUnit / ethBaseUnit

// = unscaledPriceMantissa / expScale * tokenBaseUnit / ethBaseUnit

anchorPrice = mul(unscaledPriceMantissa, config.baseUnit) / ethBaseUnit / expScale;

emit AnchorPriceUpdated(symbolHash, anchorPrice, oldTimestamp, block.timestamp);

return anchorPrice;

}接下来,简单看下 Uniswap 询价逻辑

首先通过 fetchEthAnchorPrice() 从交易对 USDC-WETH 获得按 USDC 计价 (单位 10^{6}) 的 WETH 的价格,比如为 4351156768

然后通过 fetchAnchorPrice() 从交易对 DAI-WETH 获得按 WETH 计价 (单位 10^{18}) 的 DAI 的价格,比如为 230097482692738

上面两个价格相乘,得到 1001190219118269813150784

最后,转换单位,得到按 USDC 计价的 DAI 价格,即上面的 1001190

代理

UniswapAnchoredView 自身可能升级,因此会存在新旧合约实例;升级过程中,我们必须保证两个合约的价格预言同步,且经过一段时间验证后,经由社区投票,用新合约代替旧合约,以此完成升级

然而,依据 Chainlink 的设计,聚合器只能向一个合约地址发送喂价

为了解决这个问题,在 Chainlink 聚合器与 Compound 之间,引入了一层代理合约 ValidatorProxy,它将聚合器的报价同时转发给新旧 UniswapAnchoredView 合约

由于采用的是 报价 (push) 而非 询价 (pull) 的方式,更新价格的成本由 Chainlink 承担,因此 Compound 用户无须额外支付代理层带来的 gas

审计报告见 Sigma Prime: Chainlink ValidatorProxy Security Assessment Report

代码在另一个仓库中: smartcontractkit/chainlink

function validate(

uint256 previousRoundId,

int256 previousAnswer,

uint256 currentRoundId,

int256 currentAnswer

) external override returns (bool)

{

// Send the validate call to the current validator

ValidatorConfiguration memory currentValidator = s_currentValidator;

address currentValidatorAddress = address(currentValidator.target);

require(currentValidatorAddress != address(0), "No validator set");

currentValidatorAddress.call(

abi.encodeWithSelector(

AggregatorValidatorInterface.validate.selector,

previousRoundId,

previousAnswer,

currentRoundId,

currentAnswer

)

);

// If there is a new proposed validator, send the validate call to that validator also

if (currentValidator.hasNewProposal) {

address(s_proposedValidator).call(

abi.encodeWithSelector(

AggregatorValidatorInterface.validate.selector,

previousRoundId,

previousAnswer,

currentRoundId,

currentAnswer

)

);

}

return true;

}逻辑非常直白了..